Thanks for subscribing to our newsletter. The last few months have been pretty busy for Techemynt and the NZDS, so for our issue #1, we’ve decided to summarise all of Techemynt’s major recent partnerships!

Going forward, we will keep our community updated with analytics, announcements of new partnerships, and key milestones using our fortnightly Newsletter.

Highlights of our year so far include:

- The first NZDS pool opens on Curve! 2nzd launches to the world

- NZDS on Uniswap V3

- The cumulative trading volume of NZDS on DFX crosses US$12 million

- Launch of NZDS pools on Harvest and Beefy

- NZDS launches on DeFi Portfolio protocol DeFi Basket

- Launch of NZDS on Metalend

Uniswap Pool launches

Techemynt is now available on web3’s biggest Dex! On May 27th, an NZDS/USDC pool opened on Uniswap V3.

It has become instantly popular with just over US$350,000 worth of assets locked into the pool and around US$30,000 worth of trading volume today. The NZDS/USDC pool is the 26th largest pool on Polygon (POS) Uniswap V3 by 24hr trading volume and the 30th largest by total value locked.

The $NZDS ecosystem just keeps getting bigger and bigger!

We are excited to announce the launch of a new $NZDS / $USDC @Uniswap V3 pool on the @0xPolygon network.

➡️https://t.co/szkv1XCJMI pic.twitter.com/sgBJzqWzuv

— Techemynt (@techemynt) May 26, 2022

DFX Volume Updates

In early March this year, Techemynt began a partnership with decentralised forex protocol and AMM exchange DFX. The USDC/NZDS trading pair on DFX has been a key entry point for opening NZDS to web3 users. DFX is optimised for stablecoin trading.

DFX’s mission is to bring liquidity and volume for fiat-backed stablecoins globally. DFX users offering NZDS Liquidity have also been offered healthy rewards as part of DFX’s liquidity incentive program.

Use $NZDS tokens to earn high yields in 4 steps!

1️⃣ BUY NZDS from Techemynt or from our global retail partners

2️⃣ SEND Your NZDS to @MetaMask or @TrustWallet

3️⃣ DEPOSIT Your NZDS on @DFXFinance

4️⃣ EARN Staking rewards— Techemynt (@techemynt) June 1, 2022

New Partner – Jarvis Network

In May, Techemynt launched a new partnership with decentralised forex protocol and synthetic asset platform Jarvis. As part of the launch, a new pool featuring Techemynt’s 1-for-1 backed stablecoin NZDS and Jarvis’s synthetic jNZD. The pool will go by the ‘2nzd’ moniker and LP tokens of the pool will also be known as 2nzd tokens and will be stakeable on other platforms. 2nzd is inherently yield-bearing as well.

Benefits from the deal include:

- It will offer NZDS exposure to the massive DeFi communities using Curve and Jarvis

- It will create new Yield-bearing opportunities for NZDS users

- Open New Zealand Dollar digital stablecoins (NZDS, jNZD and 2nzd) to launch on lending & borrowing markets such as Market.xyz

Techemynt and @Jarvis_Network are partnering to offer more efficient capital markets, generate #Yield-bearing opportunities, and cross-border payments.https://t.co/PbyUf3jNSw

— Techemynt (@techemynt) June 1, 2022

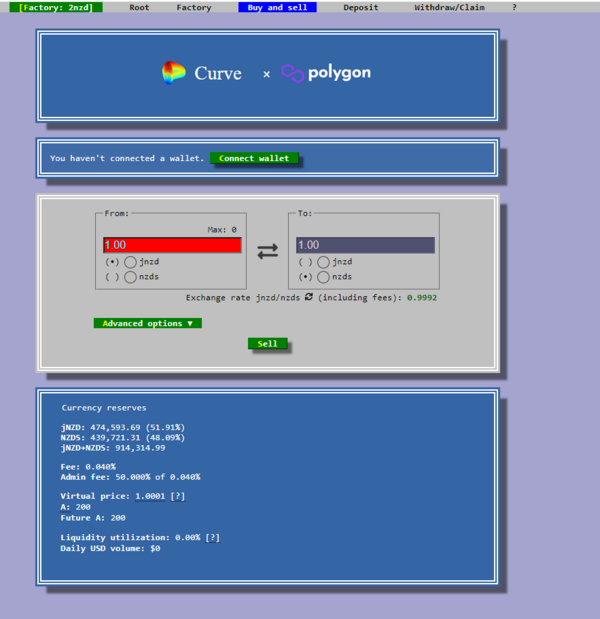

Curve Pools – the 2nzd pool – Double Kiwi

As part of the partnership with Jarvis, NZDS launched its first official pool on Curve Finance. Curve is the 2nd largest decentralised exchange in crypto behind Uniswap, with over US$4.5 billion worth of TVL locked into it. It is the go-to exchange for trading like-for-like digital asset pairs.

It offers tremendously low slippage for trading between assets that are similarly priced, so the swapping between jNZD and NZDS is near perfect. Curve’s constant product formula is different from other AMMs, allowing it to support lower slippage at a wider range of liquidity ratios.

Additionally, because NZDS are tradeable with USDC on DFX and jNZDS is minted using USDC collateral, moving assets smoothly between Jarvis and DFX to access different yield opportunities offered by the two platforms, will be cheap, fast, and have minimal slippage.

Dasset

Dasset, a local exchange partner of Techemynt, hosted Techemynt CEO Fran Strajnar. Fran explained some of the benefits and advantages of NZDS for Kiwi users.

The VOD of the seminar can be viewed here!

The NZDS-NZD pair on Dasset offers the cleanest most efficient way to go from NZDS to fiat, which can be viewed here.

How can you embrace the core use case of $NZDS, right now?

Through @Dassetx we have listed the $NZDS against the NZD. So that anybody can come along and buy or sell instantly NZD Stablecoin with New Zealand Dollars.https://t.co/LqGyfqJgwu

— Techemynt (@techemynt) April 27, 2022

Metalend

Metalend Finance, a decentralised, open-source, lending protocol on Ethereum added NZDS to its list of assets in April! Techemynt is supporting Metalend in its mission to assist extra native currencies aside from USD-denominated currencies on its platform.

📣 The $NZDS is now live on @MetalendFinance, a #DeFi lending and borrowing platform.

👉 https://t.co/ROYYf5wdgV pic.twitter.com/7nbVNJs0OD

— Techemynt (@techemynt) April 28, 2022

Harvest Finance – Super Kiwi

NZDS has integrated a market-leading yield aggregation platform – Harvest Finance. Harvest offers users a convenient way to farm new token projects, with liquidity incentive programs.

Harvest auto-compounds and users can deposit the LP tokens they receive for depositing in Harvest back into the platform to earn the platform’s native governance token FARM.

There is currently just over US$110,000 locked into the Harvest 2nzd vault. It offers a 29.5% yield to depositors.

GN Kiwis 🥝🇳🇿$jNZD hodl vault has arrived.

Brought to you by @Jarvis_Network & @CurveFinance.

Deposit & Earn: https://t.co/y4vV3uaIrI pic.twitter.com/65kIKiJ0K6

— Harvest (@harvest_finance) May 30, 2022

Beefy Finance – Super Kiwi

Additional to Harvest, an NZDS pool has just been deployed on Beefy Finance, a decentralised, multi-chain yield optimiser platform. It auto compounds yield for users who deposit their LP tokens. An excellent quality-of-life tool for DeFi users managing multiple yield revenue streams.

You like @Jarvis_Network #stablecoins? We got ‘em.

💸 $jJPY – $JPYC: 46% APY

💸 $jNZD – $NZDS: 35% APY

💸 $jSGD – $XSGD: 24% APY

💸 $jCAD – $CADC: 19% APY

💸 $agEUR – $jEUR: 16% APY@jpy_coin @techemynt @CurveFinance @PayTrie pic.twitter.com/yK9OMQ9E6Q— Beefy (@beefyfinance) May 25, 2022

DeFi Basket

On June 3rd, NZDS was the latest asset to be added to the emerging DeFi protocol DeFi Basket. DeFi basket is designed to make it easy to create and manage a crypto portfolio. In a single transaction, users can create or invest in portfolios that offer exposure to multiple assets across the DeFi space.

DeFi Basket is unique from other products in the space because it allows portfolios with yield-bearing assets to be included in the portfolio. This means it’s not just NZDS that is included on the platform, but also 2nzd, the yield-bearing LP token that represents shared ownership of the NZDS/jNZD pool on Curve.

If a user wants to include 2nzd in their portfolio, DeFi Basket will first purchase NZDS and then deposit it into the Curve pool to earn LP rewards.

Additionally, DeFi Basket can tap into aggregators and Compounders like Harvest, allowing an extra layer of yield and piggybacking.

An example of a portfolio already launched on DeFiBasket that already contains NZDS is portfolio #412. If a user deposits USDC into portfolio #412, they gain exposure to 5 yield-bearing LP tokens — jNZD/NZDS, jCAD/CADC, jSGD/XSGD, jJPY/JPYC, and agEUR/jEUR.

🇳🇿 New asset alert 🇳🇿$jNZD + $NZDS LP paying great APY. pic.twitter.com/hbpAyzilaO

— Picnic (@usePicnic) June 2, 2022