Welcome to the 12th edition of the Techemynt fortnightly newsletter. It has been an exciting fortnight for the New Zealand Dollar Stablecoin (NZDS). The release of DFX V2 has created a new dimension for NZDS staking. Now that the NZDS/USDC pool liquidity provider rewards can be boosted, rewards for NZDS LP’s may be set to grow.

It has also been a strong fortnight for NZD, with the fiat gaining steadily against the US Dollar. Despite underperforming US stocks, weak economic data from China, and steady US yields the New Zealand Dollar has risen in value versus the strongest forex asset in the world.

A key driver of these gains has been a hawkish Reserve Bank of New Zealand that a month ago pushed interest rates in the country to a 7-year high. There are market observers backing an unwinding of speculative long USD positions which could continue to boost the value of the NZD.

Highlights of the last fortnight include:

- The NZDS/USDC pool is the 3rd most voted-for pool on the new vote-escrowed DFX v2

- The total NZDS transaction volume on Ethereum is above US$200 million

- There are now over 156 unique wallets holding NZDS

- Total NZDS transfer volume on Polygon crosses US$4 million

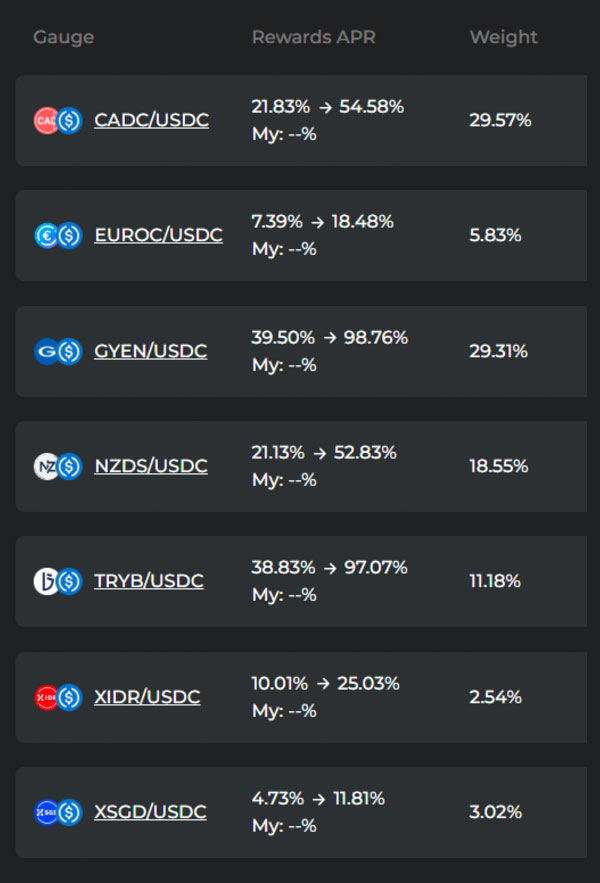

DFX Voting begins

The NZDS/USDC pool is the 3rd most voted-for pool on the new vote-escrowed DFX v2. DFX, the leading platform to stake, trade, and earn passive rewards with NZDS, has recently undergone a major upgrade. The update shifted the protocol towards a vote-escrowed or ‘ve’ tokenomics model — You can learn more about the transition to the new model in last week’s newsletter.

Vote-escrowed tokens are a special type of governance token used for voting purposes. A trusted third party holds these tokens in escrow for release if/when certain conditions are met. Ve tokens enable governance voting and can be used to earn staking rewards and boost voting on certain token pools.

During the first voting epoch for veDFX tokens, 770,000 DFX tokens were locked up for a total of 600,000 veDFX, for an average lock-up time of 2.5 years. Approximately 18.55% of the created veDFX was used to boost LP rewards on the NZDS/USDC pool.

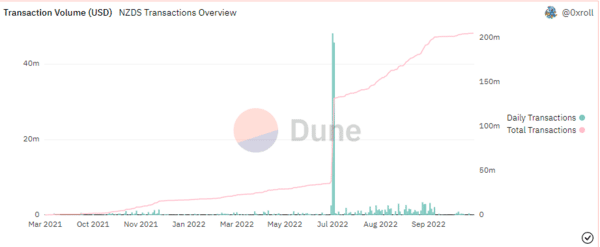

Total NZDS transaction volume

NZDS transaction volume on Ethereum has exceeded US$200 million.

The total transaction volume of NZDS on the Ethereum network is now higher than US$200 million despite the relative underperformance of the New Zealand Dollar against the US Dollar recently.

Ethereum is the world’s largest smart contract blockchain platform and the native blockchain network used for NZDS. It has recently transitioned from Proof-of-Work to Proof-of-Stake.

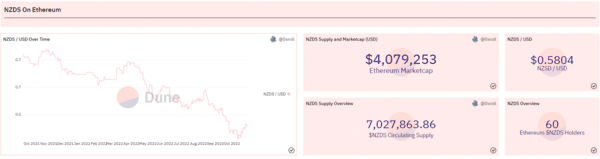

Unique NZDS Wallets

There are now over 156 unique wallets holding NZDS.

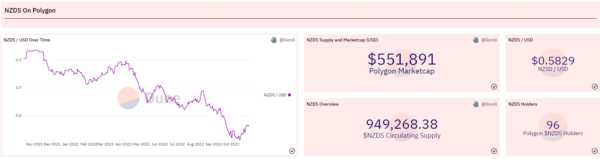

60 unique Ethereum wallets and 96 Polygon wallets are currently holding NZDS, for a combined total of 156 total wallets holding NZDS. This makes a total of 156 total wallets holding NZDS. For an emerging stablecoin crossing the 150 holders marker is a sign of the growing reach and utility of the NZDS.

A number of these wallets are exchange accounts belonging to entities like DFX and Dasset. These exchanges hold NZDS on behalf of users who trade NZDS off-chain or lock up NZDS in smart contracts. This means the number of NZDS users is actually higher than 156.

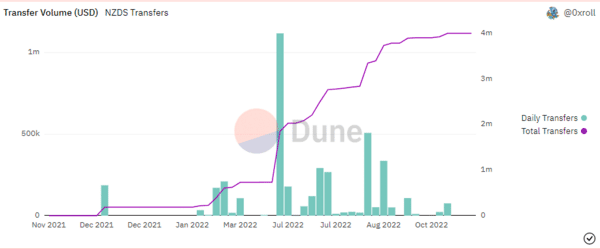

Polygon transfer volume

Total NZDS transfer volume on Polygon crosses US$4 million.

The total cumulative transfer volume of NZDS on the Polygon network currently sits at US$4,007,212. Polygon continues to be an excellent, cheaper & faster alternative to transacting on NZDS’s native network, Ethereum.

The Polygon (MATIC) network is a blockchain scalability platform that offers tools to improve existing blockchain platforms’ speed, cost, complexity, and interconnectedness. Polygon is currently focused on addressing the limitations of the largest platform blockchain in the world, Ethereum (ETH). NZDS currently utilises Polygon PoS as a layer 2 solution to support Ethereum.

On Polygon, NZDS is available for trading on Curve, DFX, and Uniswap V3.