It has been a thought-provoking June for crypto startups. The mass deleveraging and challenges faced by Celsius and Three Arrows Capital have evidenced the importance of stable treasury and governance practices, as well as community transparency. Techemynt looks forward to maintaining its high standards on these key operational processes through the potential crypto winter.

Going forward, we will update our community with analytics, new partnerships announcements, and key milestones using our fortnightly Newsletter.

Highlights of the last fortnight so far include:

- NZDS on Uniswap V3 pool launches on Ethereum

- NZDS/USDC Polygon Uniswap V3 pool 7 daily volumes approach US$500k

- The Curve 2nzd pool approaches NZ$1 Million in reserves

- Metalend Finance CEO Anthony Ng joins the Crypto Conversation

Uniswap Pool launches

Techemynt has deepened its accessibility on web3’s biggest Dex! On May 27th, an NZDS/USDC pool opened on Uniswap V3 – Ethereum.

The pool became instantly popular with just over US$375,000 worth of assets locked into the pool and daily trading volumes hitting US$182,000 on June 13th.

https://info.uniswap.org/#/pools/0x689ef72d677c0b96eb980970a549a08451c9c72e

We are excited to announce the launch of a new $NZDS / $USDC @Uniswap V3 pool on the #Ethereum network.

👉 https://t.co/j0wFkpP828 pic.twitter.com/IsbEjCgr1f

— Techemynt (@techemynt) June 9, 2022

Volume Report

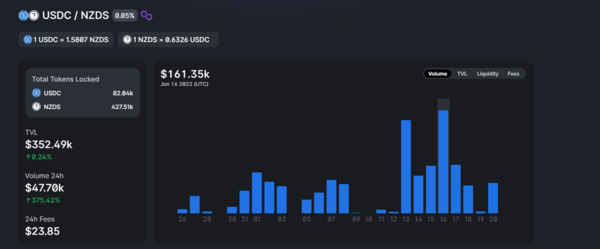

Weekly volumes on our existing Uniswap V3 pool— NZDS/USDC (Polygon) are approaching US$500,000. On Uniswap V3-Polygon, NZDS is currently the 19th most popular asset by Total Value Locked (TVL) TVL, by volume, it is 15th most popular.

The NZDS/USDC trading pair is currently the 25th most popular pair by TVL and is the 22nd most popular by 7-day trading volume. The TVL for the pool currently sits at US$352.5K and the 7-day trading volume currently sits at US$474.5K. On June 16th, total daily volume trades hit US$161.4k and fees hit US$80.67.

Weekly Trading volumes approach US$500,000 on Uniswap V3 - Polygon.

A million in reserves

NZDS on Curve approaches a key milestone.

The momentum and velocity of the Techemynt – Jarvis network partnership grows. The 2nzd pool was established as a key cog in the partnership. The 2nzd pool allows for cheap, low slippage swapping between the Jarvis Network’s synthetic New Zealand Dollar Stablecoin jNZD and Techemynt’s, 1-for-1 backed with physical dollars, NZDS.

The TVL on the pool currently sits at 966,551.6 NZD equivalent assets. The pool currently contains 438,593.04 (45.38%) jNZD or 527,958.56 (54.62%) NZDS.

NZDS can easily be swapped for NZD giving it excellent utility as an off-ramp for Kiwis in New Zealand and abroad. jNZD, meanwhile, can easily be traded for other synthetic Forex stablecoins on the Jarvis Platform.

Techemynt Research

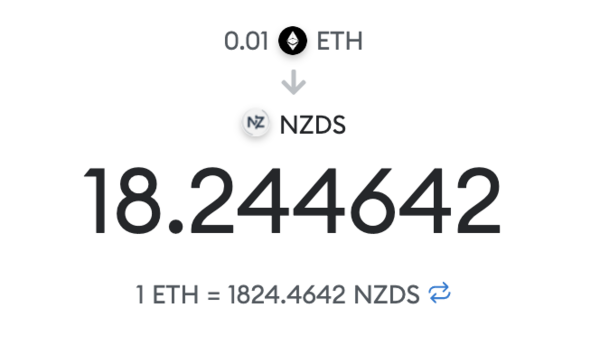

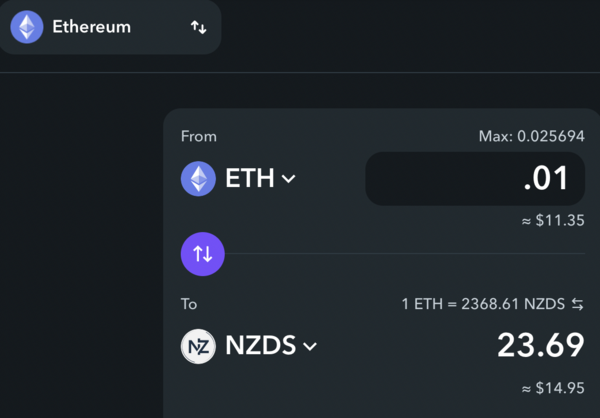

Uniswap V3 powered wallet swaps.

A useful feature of the Uniswap V3 pool is that it can be tapped into, in order to access various in-wallet swap functions. Now, NZDS can be swapped directly within MetaMask or on other web3 wallets like Zerion and Zapper.

What NZDS swapping looks like within MetaMask

Zapper_NZDS

What NZDS swapping looks like within Zapper

Podcast Appearance

Metalend joins the Crypto Conversation

Metalend’s CEO Antony Ng joined Brave New Coin’s Crypto Conversation, hosted by Andy Pickering.

Metalend is an important infrastructure component of NZDS and is our asset’s first borrowing and lending market. Techemynt and Metalend shared an aligned vision that the future of payments in DeFi is much bigger than the US Dollar. DeFi is global and users need local fiat options. The majority of the Crypto borrowing and lending market is focused on USD stables and Metalend is a groundbreaker for the non-USD stablecoin ecosystem.

“We aim to create a whole new community that is more comfortable trading in their home currency” Anthony explained during the podcast.