Hello subscribers! Welcome to the 4th edition of the Techemynt fortnightly newsletter.

This week investors across Crypto, forex and equities all have their focus firmly fixed on the United States Federal Reserve. The US Central Bank holds its latest policy meeting this Wednesday and will then reveal a major interest rate decision.

The Fed is expected to raise rates by 75 basis points (bps) but given surging inflation, strong jobs and consumer data, they may be tempted to raise them higher. A 1% interest rate hike would shock markets and affect the trading of the NZD/USD pair.

After its June meeting, the Federal Reserve increased the funds’ rate by 75 bps to push the rate in the US 1.5%-1.75%. This was higher than the 50bps rise initially expected. Following the rates hike – the USD to NZD rate jumped from 1.58 to 1.61, with markets likely backing the Fed’s stronger actions.

NZDS holders trading via USDC pairs, look out for price action around the days of the Fed announcement.

Highlights of the last fortnight include:

- Scott Gentry from Techemynt joins the Crypto Conversation

- Jarvis CEO Pascal joins the Crypto Conversation

- NZDS included as a part of the latest Jarvis Network Rewards program

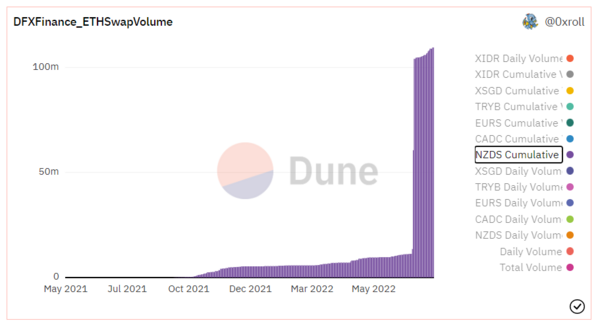

- The total cumulative volume of NZDS on DFX crosses US$100 million

Techemynt on the Crypto Conversation

This week Techemynt’s head of business development, Scott Gentry, appeared on Brave New Coin’s Crypto Conversation. Scott discussed all things NZDS and Techemynt. The podcast laid out Techemynt’s long & short-term goals. The podcast is an excellent listen for anyone that wants to learn a little bit more about how Techemynt works underneath the hood.

After working in Traditional finance at places like Standard & Poor’s in New York, and Reuters and Cantor Fitzgerald in Tokyo, Scott has spent the last four years in the digital asset space with Techemy Capital, Brave New Coin, and now with Techemynt to build out the market for the New Zealand Dollar Stablecoin, NZDS.

“It’s like the traditional system is not working after all these years of quantitative easing and 0 interest rate policy. We think people are hungry for change, they sense that the system is broken and DeFi gives them another option to be in charge of their finances without getting scalped by multiple intermediaries. In that regard, the overall plan is to hit on a few areas of major focus which is to increase adoption and accessibility both in DeFi in the DeFi realm and with real-world applications as well as liquidity.”

Listen Now

On Apple Podcasts

On Spotify

On Youtube

On Stitcher

Or Download HERE

🎙️On the Crypto Conversation podcast @AndyPickeringNZ is with Scott Gentry from @TechemyCapital to discuss his work with @techemynt building new markets for the $NZDS New Zealand Dollar Stablecoin. Listen! 🎧 https://t.co/t7HGayTijV

— Brave New Coin (@bravenewcoin) July 13, 2022

Jarvis on the Crypto Conversation Podcast

Pascal Tallarida is the founder of Jarvis Network, a trading platform whose mission is to bring decentralised finance to everyone. As part of the partnership with Jarvis, NZDS launched its first official pool on Curve Finance.

Stablecoins have a crucial role to play in DeFi adoption. The non-USD stablecoins struggle to be liquid and maintain their peg. This is where Synthereum, the first protocol of the Jarvis Network, comes into play to solve these issues and launch non-USD stablecoins (JFIATs). The protocol pioneers a capital-efficient manner to issue and exchange synthetic fiat currencies, jFIATs, on multiple EVM-compatible networks, without price impact.

“The bigger picture or vision for Jarvis is not just about building another exchange or a DeFi protocol or a wallet. It’s about really trying to innovate and redesign the user experience of personal finance by leveraging different technology stacks. We don’t try to do things for DeFi people, we really try to push the adoption and to funnel our effort towards real-world use cases or things that could be valuable both in a bear or bull market.”

Listen Now

- On Apple Podcasts

- On Spotify

- On Youtube

- On Stitcher

- Or Download HERE

🎙️On the Crypto Conversation podcast @AndyPickeringNZ is with @pscltllrd founder @Jarvis_Network – stable and liquid synthetic fiat currencies powered by an on-chain Forex market 🎧 https://t.co/oEChqY77LL

— Brave New Coin (@bravenewcoin) July 14, 2022

The latest Jarvis Network Rewards program

NZDS is included as a part of the latest Jarvis Network Rewards program.

In May, Techemynt launched a new partnership with decentralised forex protocol and synthetic asset platform Jarvis. As part of the launch, a new pool featuring Techemynt’s 1-for-1 backed stablecoin NZDS and Jarvis’s synthetic jNZD.

The reward tokens by liquidity providers during the program are initially futures which can be redeemed at the end of the September program. Participants can either sell their reward tokens right away or keep them until their maturity. Jarvis has set up USDC trading pools where the futures can be traded.

A recently completed governance proposal revealed that the Jarvis community had voted to include liquidity providers of the NZDS/jNZD curve pool in the latest Jarvis Network Rewards program. LP tokens from the pool are often referred to as 2nzd tokens. 1.44 million JRT tokens will be awarded across contributors to the Jarvis NZD, EUR, SGD, CAD, and JPY stablecoin pools operated by Jarvis.

1⃣ JRT-SEP22

100 JRT-SEP22 have been issued. This token starts at a price of $216 and tracks the value of 1.44M $JRT.

Users need to provide liquidity in the #2eur (EURT), #2cad, #2nzd, #2jpy, and #2sgd pools on Curve or in the JRT-SEP22-USDC pool on Kyber.

3/6

— Jarvis Network 🧪🦇🔊 (@Jarvis_Network) July 25, 2022

Total cumulative volume of NZDS

The total cumulative volume of NZDS on DFX-Polygon crosses US$100 million.

The total cumulative volume of NZDS on the Ethereum version of decentralised exchange DFX has just crossed US$100 million. DFX Finance is a decentralised foreign exchange (FX) protocol optimised for trading fiat-backed stablecoins.

The NZDS/USDC pair on DFX is one of the most popular markets to trade NZDS because of its idiosyncratic pricing model that ensures low slippage trading while still maintaining the flexible liquidity of an AMM.

An automated market maker (AMM) allows the decentralised exchange of tokens according to a bonding curve. Most AMMs determine the price of a pair based on the amount of each token supplied, for DFX, this curve will be dynamically adjusted by using real-world FX price feeds from Chainlink to ensure that you get the best rates.

NZDS Cumulative Volume at $109,550,251.49