Hello subscribers! Welcome to the 6th edition of the Techemynt fortnightly newsletter. Over the last fortnight, prices across digital asset markets have pulled back. A key creator of this bearish environment is surging global inflation.

German producers paid 37.2% more for commercial goods in July 2022, compared to the same month the previous year. This is the highest recorded jump since 1949. It captures the triple-digit percentage prices that industries have had to pay for energy as Germany has attempted to move away from the use of imported natural gas from Russia in response to Moscow’s invasion of Ukraine.

Without significant government intervention like tax cuts, it appears likely these high prices will pass on to consumers. With one of Europe’s largest economies struggling to deal with rising stagflation tides, it appears that much of the global economy is fighting the same battle.

Traders sold out of perceived risk assets, like speculative crypto, because of fears that a recession driven by rising costs may occur. They may turn to solutions like DeFi which offers users access to stable (high) yield-bearing assets. NZDS is one such asset that some investors holding risk assets may turn to. Protocols like DFX and Jarvis are offering double-digit yields to liquidity providers in pools containing NZDS and other stable assets.

Highlights of the last fortnight include:

- Midas Capital

- Harvest Finance

- The total cumulative volume of NZDS

Beefy Finance taps into the latest

A new NZDS-driven vault has recently been launched on Beefy Finance. The Beefy 2NZD pool auto compounds for liquidity providers to the NZDS-jnzd pool on Curve. The Curve pool which was launched by the Jarvis.network platform, offers LPs rewards in the form of Jarvis tokens. The NZDS/jnzd pool was accepted into the latest Jarvis rewards program following a community governance vote and rewards began in late July.

Beefy offers users a convenient way to farm native tokens that are a part of the liquidity incentive program.

Beefy auto-compounds and users can deposit the LP tokens they receive for being liquidity providers for AMM pools.

An auto-compounder collects Liquidity provider rewards for depositors, over what the platform calls the optimal reward period and re-invests them into the platform. They then stake native tokens and redeposit tokens into pools to ensure that the earnings are maximised. All operations are conducted through smart contracts.

Beefy Finance simplifies the process for long-term LP providers to earn rewards and removes the process of signing transactions and paying gas periodically to earn maximum rewards.

So I hear you like synthetic fiat currencies.

We got synthetic fiat currencies vaults.@jarvis_network synthetic fiat currencies vaults.

We got a bunch of synthetic fiat currencies vaults.

Synthetic fiat currencies vaults, right here 👇 pic.twitter.com/cyqOSabIQ8— Beefy (@beefyfinance) July 28, 2022

Midas Capital

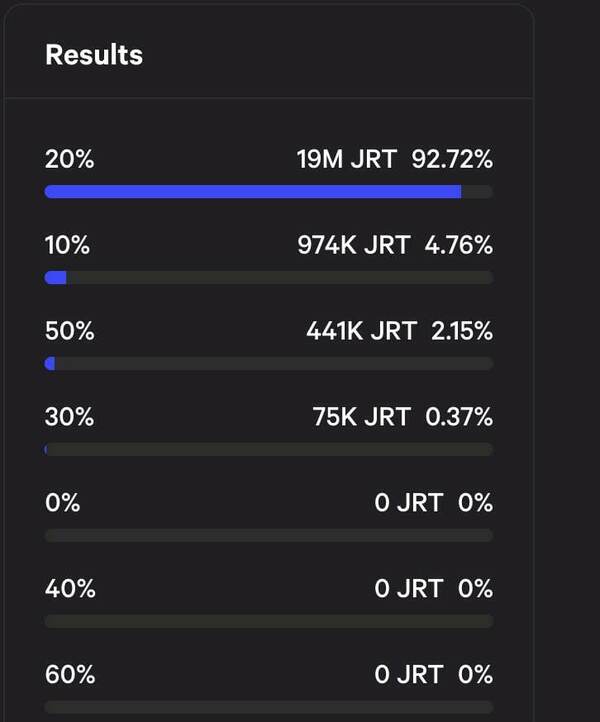

The community of key NZDS partner, Jarvis, recently completed a vote to decide the protocols primary 3rd party borrowing and lending market. The poll asked the Jarvis community whether Midas, as opposed to Marketxyz, should be used as the primary liquidity pool for borrowing and lending was being put to a vote.

Midas Capital is a money market platform that allows anyone to create customised and isolated pools for lending and borrowing any asset. The solutions it offers are comparable to Aave, Compound and Rari Capital.

This vote went through with over 90% support. This means that Midas Capital may become one of NZDS’s primary money markets. Once the integrations between Midas Capital and Jarvis Network are fully completed users are set to be able to put up collateral to borrow NZDS LP tokens, NZDS and jNZD. Alternatively, NZDS and jNZDS LP token holders can act as lenders and offer liquidity to the platform for yield and platform rewards.

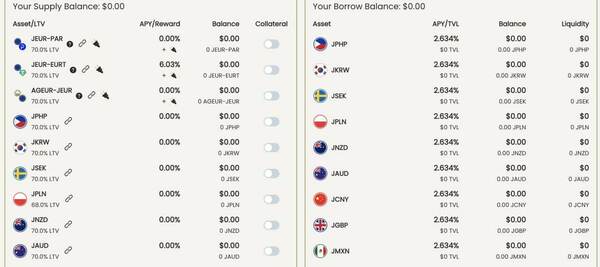

The 2NZD pool is now live on Midas.

The 2NZD pool is now live on Midas

Harvest Finance

The 2NZD pool with updated rewards is now live on the Harvest Finance platform. The 2NZD pool is hosted on Curve and the Jarvis network taps into it to support NZD stablecoin trading.

Harvest a market-leading yield aggregation platform – Harvest Finance. Harvest offers users a convenient way to farm new token projects with liquidity incentive programs.

Harvest auto-compounds and users can deposit the LP tokens they receive for depositing in Harvest back into the platform to earn the platform’s native governance token FARM.

Depositors can now deposit their 2nzd pool tokens into Harvest which will auto compound their liquidity provider rewards from Jarvis and Curve. Harvest currently offers depositors an attractive 23.82% APY for deposits.

The second most important event for crypto in 2022 (besides the Merge) is clearly & undoubtfully the latest batch of @Jarvis_Network stablecoin vaults on Harvest.

Powered by the almighty @CurveFinance & @KyberNetwork DMM.

Featuring $agEUR of @AngleProtocol

Godspeed, farmers 👩🌾 pic.twitter.com/lC57nT8EVO

— Harvest (@harvest_finance) August 11, 2022

The total cumulative volume of NZDS

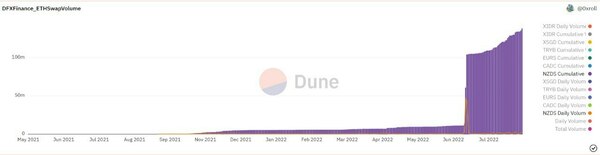

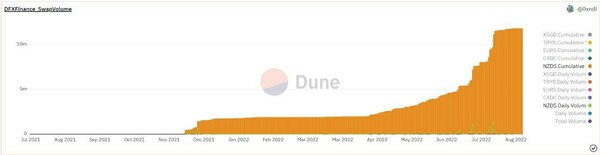

The total cumulative volume of NZDS on the Ethereum and the Polygon version of decentralised exchange DFX has just crossed the US$145 million mark. The total cumulative volume for NZDS across the two networks currently sits at US$147.4 million DFX Finance is a decentralised foreign exchange (FX) protocol optimised for trading fiat-backed stablecoins.

NZDS is currently the 4th most popular asset by AUM on the platform behind CAD-C, XSGD and EURS.

NZDS DFX volumes on the Ethereum network

NZDS DFX volumes on the Polygon network